Software company Asana (NYSE: ASAN) provides a work management platform to enterprises and businesses. It helps teams to organize work from daily activities to cross-functional strategic initiatives.

In the current era of digital transformation, Asana is gaining momentum with its unique product strategy and rising big customer wins. The company’s increasing revenue mix of the business and enterprise groups depict its durable growth profile.

Recently, Asana reported a smaller-than-feared loss in the first quarter of Fiscal 2023 (ended April 30) and surpassed analysts’ revenue expectations. Furthermore, the company’s solid guidance demonstrates long-term growth prospects.

Despite the beat, shares of the mobile work management platform declined 3.82% in Thursday’s extended trading session, after closing 13.73% higher on the day.

Results in Detail

Asana registered an adjusted loss of $0.30 per share in Q1, compared to the $0.35 loss per share estimated by analysts. The company posted an adjusted loss of $0.21 per share in the same quarter last year.

Total revenues stood at $120.6 million, beating the consensus estimate of $115.11 million and up 57% year-over-year. Record results reflect an increasing customer base.

Furthermore, the number of customers spending $5,000 or more on an annualized basis surged to 16,689 in the quarter, up 48% year-over-year. Interestingly, revenues from these customers were up 73%.

Meanwhile, the number of customers spending $50,000 or more on an annualized basis grew to 979, up 102% year-over-year.

CFO’s Comments

Asana CFO Tim Wan said, “Looking forward, we are actively managing our cash burn, and we’re pacing our investments in a more measured way given the macroeconomic backdrop. We are proud of the business momentum, especially as assessed with very large deployments at great iconic brands and the velocity innovation this year.”

Guidance

For Fiscal Q2, Asana forecasts revenue in the range of $127 million to $128 million, reflecting year-over-year growth of 42% to 43%. The consensus estimate is pegged at $125.38 million. Adjusted loss per share is anticipated to land between $0.39 and $0.38, versus the Street’s estimated loss of $0.32 per share.

For Fiscal 2023, total revenue of $536 million to $540 million is expected, which would represent year-over-year growth of 42% to 43%. Analysts’ expectations stood at $530.66 million.

Analysts’ Recommendation

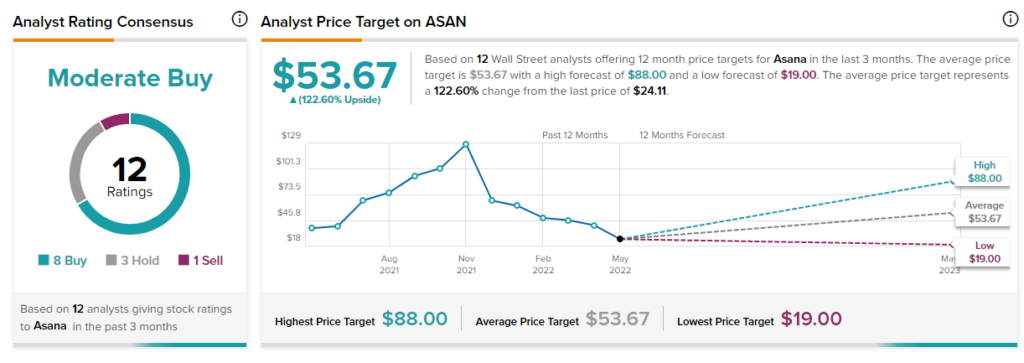

The Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating, based on eight Buys, three Holds, and one Sell. The average Asana price target of $53.67 implies 122.6% upside potential. Shares have lost 34.47% over the past year.

Website Traffic

The earnings results were evident on TipRanks’ new tool that measures visits to Asana’s website. Pre-earnings, we were able to see insights into Asana’s performance in the April quarter.

According to the tool, a website traffic uptrend was visible. In Fiscal Q1 2023, total visits on asana.com showed an increasing trend, on a global basis, representing a jump of 57.88% on a year-over-year basis.

The predictions that were based on TipRanks’ website visits data turned out to be correct, with Asana reporting record revenues in Fiscal Q1 2023 and ending the quarter with more than 126,000 paying customers.

Bottom-Line

Given the current macroeconomic backdrop, Asana’s investments reflect remarkable business momentum and strong customer engagement. It seems to be supported by Wall Street analysts’ consensus and website trends on TipRanks’ Website Traffic Tool as well.

Read full Disclosure

from WordPress https://ift.tt/7loRQMc

via IFTTT

0 Commentaires